What are the similarities and differences in delisting systems for different stocks?

2024.03.13

The delisting system of Hong Kong stocks

1. Delisting situation of Hong Kong listed companies

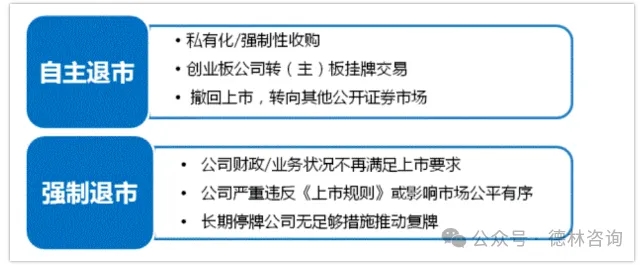

The regulatory framework for delisting of Hong Kong listed companies includes the Hong Kong Stock Exchange Listing Rules (referred to as the "Main Board Listing Rules") and the Hong Kong Stock Exchange GEM Listing Rules (referred to as the "GEM Listing Rules"), as well as related application guidelines, mainly including the Main Board's "Application Guidelines 11" and "Application Guidelines 17". The Hong Kong Stock Exchange will delist listed companies that no longer meet the listing and trading conditions, which means their listing status will be revoked and they will be transformed into non-public companies. The Hong Kong securities market does not have an over-the-counter trading market, but implements a "one exit to the end" system. Therefore, most companies forced to delist will enter bankruptcy liquidation procedures after delisting. According to different delisting intentions, listed companies usually face two situations: "voluntary delisting" and "forced delisting".

2. Hong Kong delisting rules and procedures

The delisting system of listed companies in Hong Kong is closely related to the listing system. In addition to triggering delisting conditions due to the issuer's financial condition, business operations, capital operations, and other reasons, during the securities listing and trading period, the company must continue to meet the relevant standards stipulated in the Listing Rules and assume credit reporting responsibilities. Otherwise, the Hong Kong Stock Exchange may take temporary suspension, suspension until delisting measures at any time to maintain market order. In May 2008, after the revision of the "ChiNext Listing Rules", the "ChiNext Listing Rules" were basically consistent with the main board companies in terms of "public shareholding ratio", "sufficient business operations and tangible/intangible assets" and other conditions that may trigger delisting. In addition, the new regulations have simplified the process of transferring to the ChiNext board, leading to a rapid increase in the proportion of ChiNext companies that have been delisted from the board. In order to protect the rights and interests of investors and maintain market order, the Hong Kong Stock Exchange has revised the Listing Rules and related guidelines of the Main Board and the Growth Enterprise Market multiple times, making the delisting principles and standards of listed companies at different levels of the securities market as consistent as possible. The Hong Kong Stock Exchange will evaluate whether the listed company can continue to fulfill its responsibilities and decide whether to delist it. The delisting conditions mainly involve the company's main business, operating assets, compliant operations, securities trading, information disclosure, shareholding structure, and other aspects. 2. The 17th guideline of the Main Board Listing Rules stipulates the delisting procedure for main board companies, which applies to companies that do not meet the "sufficient business operation" requirements stipulated in Article 13.24 of the Main Board Rules. The delisting process is divided into four stages: initiation, review, implementation, and completion. During the suspension period, listed companies can strive to restore their listing status by submitting proposals for resumption of trading (restructuring). The Listing Committee, Listing (Review) Committee, Listing Appeal Committee and other institutions of the Stock Exchange will review the company's proposal for resumption of trading and decide whether to approve it based on whether the restructuring plan meets the conditions for relisting. If the resumption proposal of the suspended company is rejected, it will enter the final delisting process. Usually, the time from suspension to delisting of a main board company exceeds the theoretical 18 month period.

3. The operation of Hong Kong's delisting mechanism

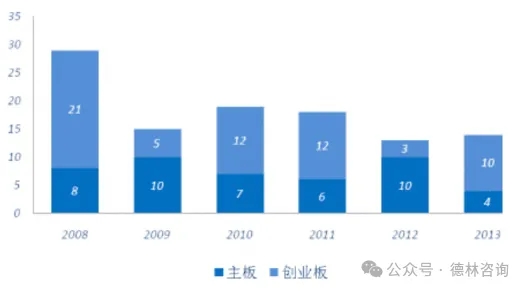

From 2008 to 2013, according to the Hong Kong Stock Exchange Market Information, a total of 108 companies were delisted from the main board and the ChiNext board, accounting for 36% of the total number of delisted companies in the history of the Hong Kong Stock Exchange. Among them, 45 companies were delisted from the main board, and 63 companies were delisted from the ChiNext board (including those transferred to other boards). Apart from the abnormal growth caused by the 2008 financial crisis, the number of delistings in the Hong Kong securities market has remained relatively stable in recent years, averaging around 15 per year. Compared to other mature overseas markets, Hong Kong has a lower annual delisting rate of less than 1%. We believe that this may be because Hong Kong's delisting mechanism does not have over-the-counter markets similar to those in countries such as the United States and the United Kingdom for transferring delisted stocks. Once a company is delisted, the interests of the original public shareholders will be further damaged, so the Hong Kong Stock Exchange usually makes a more cautious decision to delist a company according to the Listing Rules.

4 Analysis of delisting of Hong Kong main board

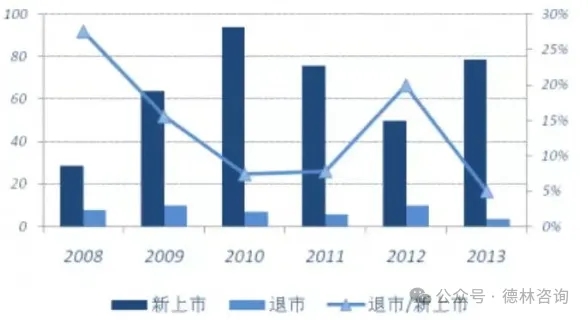

Between 2008 and 2013, a total of 392 companies were listed on the Hong Kong Main Board (including those listed on the ChiNext board), while 45 companies were delisted. Therefore, the ratio of mainboard delisting to new listing is about 1:9. The average annual delisting/new listing ratio is 11.48%.

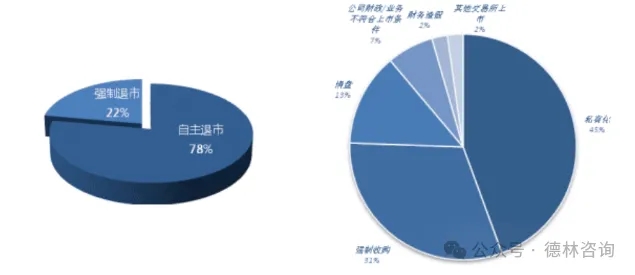

There are 35 cases of voluntary delisting and 10 cases of forced delisting, so the ratio of voluntary delisting to forced delisting is 3.5:1. The main reason for voluntary delisting is that the value of listed companies is undervalued, leading to major shareholders choosing to privatize or be acquired by other companies and delisting. In contrast, the main reasons for companies being forcibly delisted by the Stock Exchange are due to liquidation, insolvency or loss of sustainable operating ability during trading suspensions, as well as serious violations (only one case, namely financial information fraud in Hongliang International's IPO). Due to the absence of trading indicators (such as stock price, market value, and trading volume) in the delisting conditions of the Stock Exchange, the number of companies that have been forcibly delisted is relatively small.

5. Analysis of delisting of Hong Kong main board

The delisting system in Hong Kong continues the core of substantive review for listing. The new stock issuance system in Hong Kong adopts an approval system. The Listing Rules of the Main Board and the Growth Enterprise Market provide the Hong Kong Stock Exchange with flexible discretion regarding the eligibility of issuers for listing. The Listing Committee not only conducts a formal review of the information disclosed by the issuer, but also participates in the substantive judgment of the securities value (i.e. investment risk), and ultimately decides whether the stock is suitable for issuance. The Exchange reserves absolute discretion to accept or reject listing applications (including applications to transfer from the Growth Enterprise Market to the Main Board), and even if the applicant meets the relevant conditions, it does not necessarily guarantee their suitability for listing. Therefore, Hong Kong's delisting system is similar to the issuance approval system. The Exchange may, at any time and under such circumstances and conditions as it deems appropriate, order the temporary suspension or delisting of any securities. This is an extension of the regulatory authority over the substantive review of stock issuances and a requirement for the integrity of the listing system. The delisting system in the Hong Kong market has significant flexibility. The delisting system in Hong Kong is mainly reflected in the flexibility of issuer quality regulation and delisting cycle: - The definition of issuer quality regulation is broad, and the subjectivity of regulation is strong. The Stock Exchange of Hong Kong has decided to delist the securities if it considers that the issuer is no longer suitable for listing, lacks sufficient business operations, or has tangible assets of considerable value, or if it can be determined that the remedial actions submitted by an issuer that has been suspended from trading for a long time are insufficient to restore its listing status. This is a manifestation of the substantive review power of the Hong Kong Stock Exchange. The problem brought about by the limited quantifiable standards and broad definitions of delisting is that regulatory decisions are prone to controversy. For example, the Three Yuan Group case on the Hong Kong main board. The company (formerly using securities code 00388HK) has repeatedly proposed to resume trading during its four-year suspension, but has been repeatedly rejected by the Listing Committee, Listing (Review) Committee, and Listing Appeals Committee. In the end, the company entered the judicial review process and sued the Hong Kong Stock Exchange for subjective interpretation of the resumption standards and inconsistent sentencing standards. The court supported the plaintiff and questioned the lack of objective standards for the turnover of companies under Sanyuan, which was determined by the Stock Exchange to not comply with the Listing Rules. The court requested the Stock Exchange to reorganize the Listing Appeals Committee to handle the resumption of trading of the company. Although the Three Yuan Group case ultimately did not change its delisting fate after being successfully appealed to the court by the Hong Kong Stock Exchange, the case also exposed the problem of insufficient rigidity in Hong Kong's delisting quantification standards.The delisting system of A-shares

The increasing number of IPO companies in the A-share market has led to a rapid expansion of the market size, but delisting has always been a major challenge for the market. Every year when annual reports are disclosed, there will always be a group of companies that have been continuously losing money and should have faced delisting, doing their best to maintain their listing status. They have taken various measures to preserve their shell, including receiving large subsidies, selling assets, shareholders giving away funds without compensation, debt forgiveness, and even conducting shell mergers. Recently, * ST Jinyu announced that the company's net profit for the year 2017 was positive, and the company will submit an application to the Shenzhen Stock Exchange to withdraw the delisting risk warning, which means successful shell protection* ST Jinyu's previously released annual report showed that the company achieved a revenue of 302 million yuan and a net profit of 21.74 million yuan in 2017, successfully turning losses into profits. However, in reality, * ST Jinyu's net profit after deducting non recurring gains and losses in 2017 was only 930000 yuan, which can only be considered as a positive net profit. One of the main reasons for the difficulty of delisting in the A-share market is that companies always generate various "non recurring gains and losses" income at critical moments.

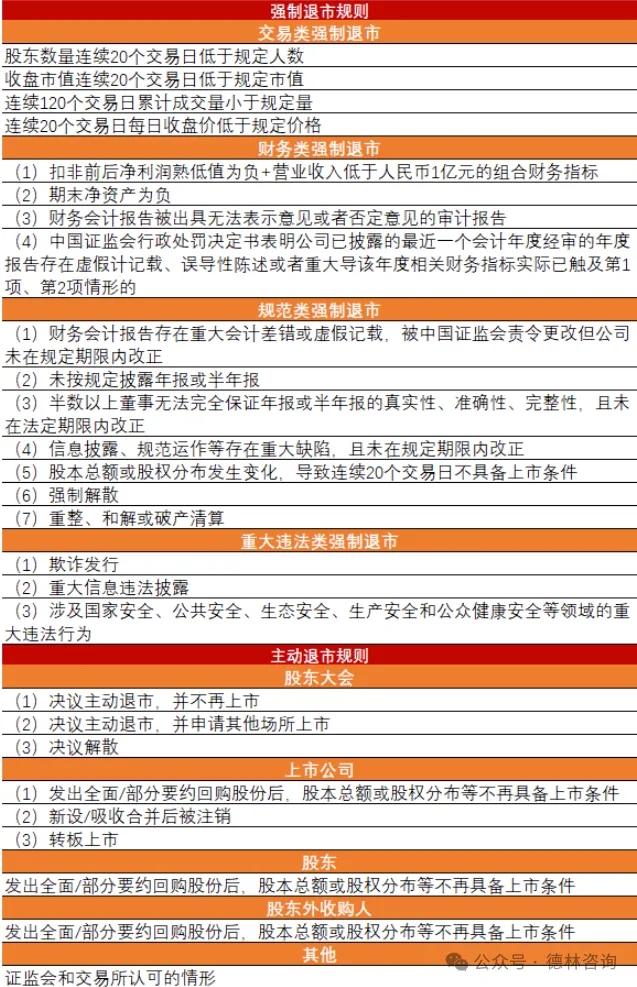

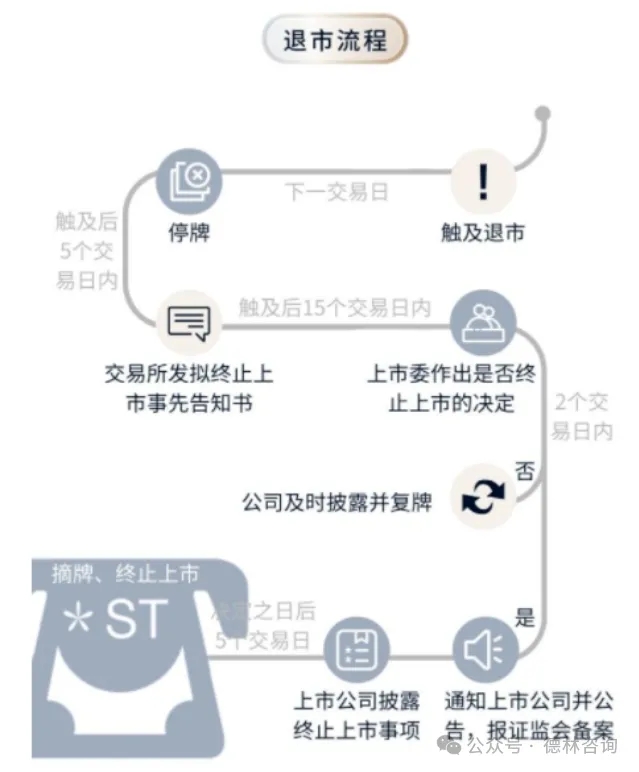

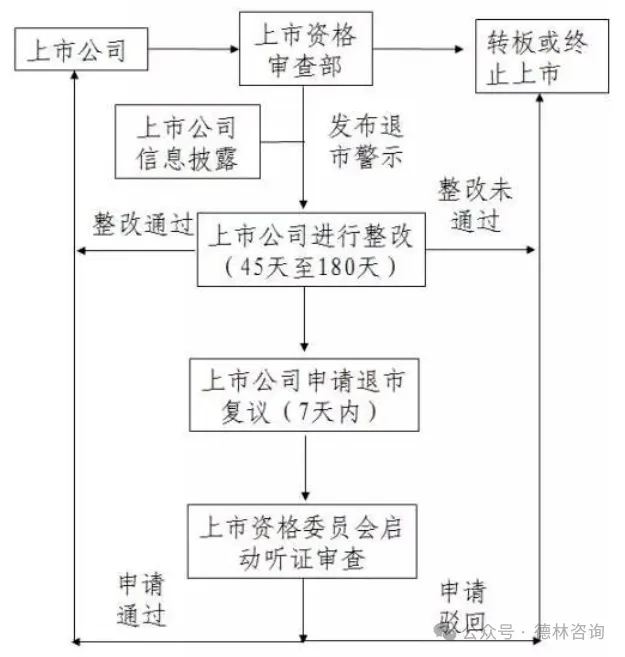

After A-shares are delisted, there is a detailed delisting process:

The delisting system of the US stock market

1. The delisting mechanism of US stocks

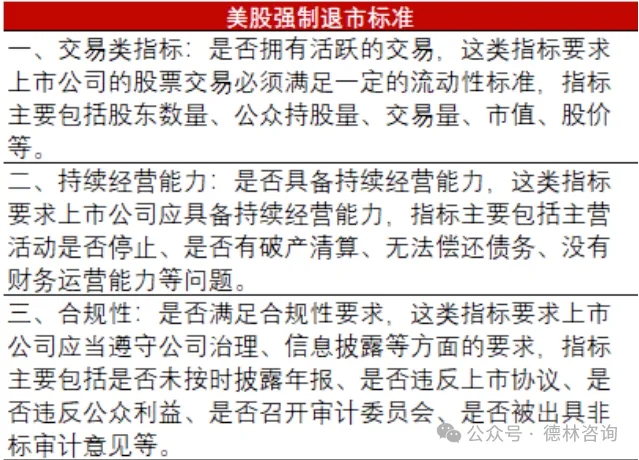

Generally speaking, companies listed in the United States have two main forms of delisting: 1 Active delisting: refers to the acquisition of a listed company by its management or a third-party private investment group. 2. Passive delisting: refers to a situation where a listed company is delisted from trading by regulatory authorities, institutions, or stock exchanges. The main reasons include failure to pay annual fees, transaction prices below the prescribed level, violation of transaction regulations or illegality, bankruptcy or liquidation, etc. Specifically, the reasons for passive delisting may include the following situations: (1) the number of company shareholders is less than 600, and the number of shareholders holding more than 100 shares is less than 400; (2) The general public holds less than 200000 shares of stocks, or their total market value is less than 1 million US dollars; (3) Operating losses in the past 5 years; (4) Total assets are less than 4 million US dollars and have incurred losses in each of the past 4 years; (5) Total assets are less than 2 million US dollars and have incurred losses in each of the past 2 years; (6) No dividends for 5 consecutive years.

2. The delisting regulations of the New York Stock Exchange

1. US Stock Exchange delisting rules - The circumstances in which a company will be delisted include: (1) the number of public shareholders does not meet the standards set by the exchange; (2) The trading volume of stocks has sharply decreased, falling below the minimum standard set by the exchange; (3) Due to factors such as asset disposal and freezing, the company has lost its ability to continue operating; (4) The court declares the company bankrupt and liquidated; (5) Poor financial condition and operating performance; (6) Failure to fulfill information disclosure obligations; (7) Violating the law; (8) Violation of the listing agreement.

The famous American company "Two Houses" may soon exit the New York Stock Exchange due to long-term stock prices below $1 caused by billions of dollars in losses.

2. The delisting rules of NASDAQ: If a listed company fails to meet the following requirements for continuous listing, it will lose its listing qualification: (1) tangible net assets not less than 2 million US dollars; (2) Market value not less than 35 million US dollars; (3) The net income for the most recent fiscal year or two of the most recent three fiscal years shall not be less than 500000 US dollars; (4) The public shareholding shall not be less than 500000 shares; (5) The market value of public shareholding shall not be less than 1 million US dollars; (6) The minimum bid price shall not be less than 1 US dollar; (7) There shall be no less than 2 market makers; (8) The number of shareholders shall not be less than 300.

If the company's stock is below the minimum trading price by $1 for more than 30 trading days, a delisting warning will be issued to the company and it will be required to improve its performance within 90 days to bring the stock price back to an "acceptable" level above the minimum trading price. Otherwise, the company will be ordered to delist. In some cases, Nasdaq may grant companies on the delisting list a grace period of more than three months, provided that the company proves that its net income exceeds $750000, shareholders hold more than $5 million in stock, or the company's market value exceeds $50 million.

Comparison of delisting systems

1. Whether the institutional standards are clear: The delisting system for US stocks is the most clear, followed by A-shares, and Hong Kong stocks are the most extensive. The delisting criteria for the US and A-share markets adopt a combination of quantitative and non quantitative indicators, while the Hong Kong stock market only uses non quantitative delisting criteria. In the US and A-share markets, the delisting criteria are relatively clear, including a series of quantitative indicators and non quantitative indicators based on performance, finance, and other aspects. However, in the Hong Kong stock market, the delisting criteria are relatively broad, and the Hong Kong Securities and Futures Commission and the Hong Kong Stock Exchange have significant subjective judgment power over whether a company should delist.

2. Execution intensity: The delisting execution intensity of US stocks is strong, while that of Hong Kong stocks and A-shares is weak. About half of the delisted companies in the US stock market were forced to delist, indicating a high degree of enforcement of the delisting system. Although A-shares use a combination of quantitative and non quantitative standards to develop delisting indicators, the effectiveness of delisting implementation is not as good as that of US stocks. Compared to this, although the delisting system of A-shares seems clearer and more specific than that of Hong Kong stocks, the actual implementation is not sufficient, and the delisting companies and delisting rates of A-shares are lower than those of the Hong Kong stock market.

- Gathering Talents and Initiating a New Journey: Dr. Xuefeng Sun Joins SGCI Group as Global Partner and Jing Dong Hui Joins SGCI Capital 2025.02.24

- SGCI Capital and Youpinhui sign financing service agreement to support the development of the capital market 2024.09.19

- SGCI Capital Helps with 2024 China Shenyang Haizhi Innovation and Entrepreneurship Competition 2024.08.30

- What are the similarities and differences in delisting systems for different stocks? 2024.03.13

- Accurate market value management: helping enterprises double their wealth 2024.03.13